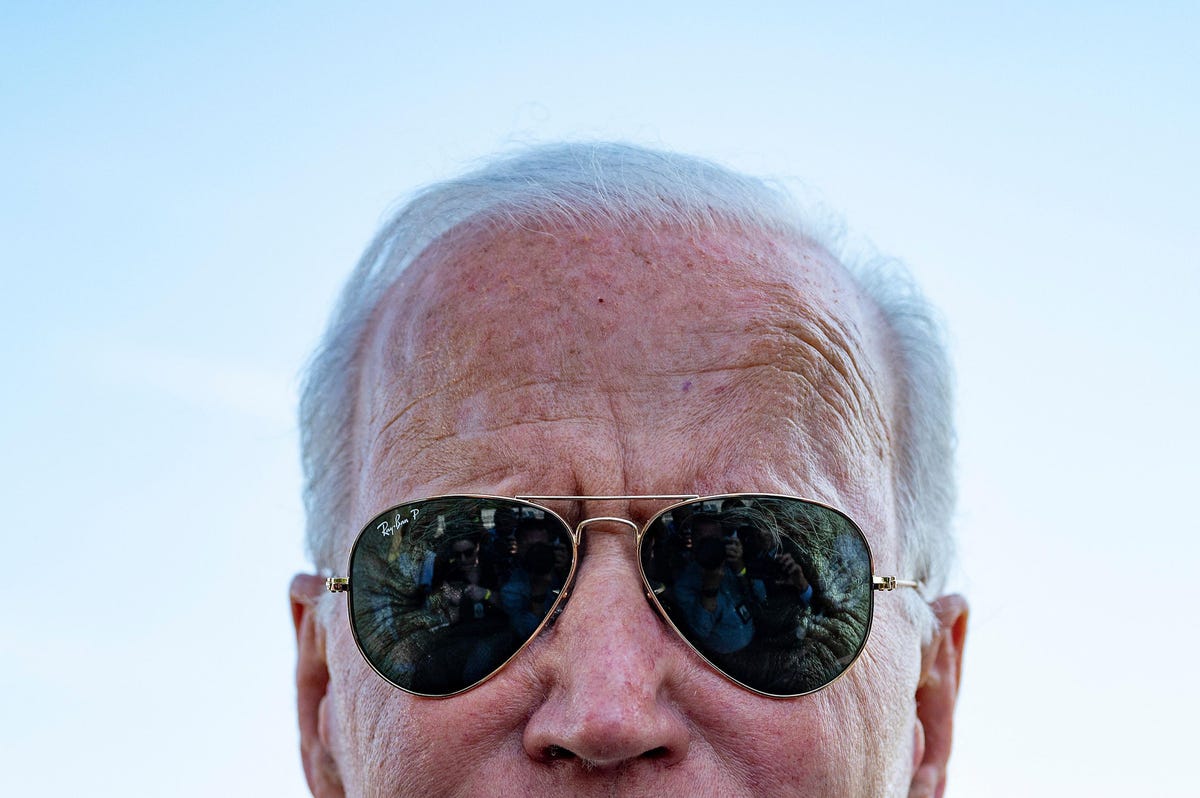

Getty Photos

Funding secured—no, actually, Elon Musk guarantees, funding secured.

Musk, the man who as soon as famously joked about privatizing one public firm, is working to guarantee Twitter buyers on Thursday about his intentions to purchase the enterprise. In a brand new SEC filling, he said he’d finance the $43 billion supply for Twitter via a mixture of Morgan Stanley debt and fairness financing he’d contribute himself. In all, Musk says, he has lined up $46.5 billion, giving himself just a little cushion to work with.

By adopting a poison pill defense final Friday, Twitter’s board has signaled it isn’t a lot focused on Musk’s proposal. So Musk will want the assist of Twitter shareholder if he desires to make this occur.

They’re not bought on it but both. Twitter inventory rose solely 0.4% on Thursday to $47.08 a share, significantly lower than Musk’s $54.20-a-share supply. The inventory has risen since Musk went public with the takeover per week in the past, however there has remained a spot between the present share worth and Musk’s supply worth, a blinking warning mild that buyers aren’t assured he’ll pull it off. Or possibly they don’t need him. Possible, a mixture of each.

It is essential for Musk to win broad shareholder assist. The poison capsule and the board’s reluctance to interact with him means the subsequent step is a proper tender supply. In such a transaction, Musk will ask shareholders to promote him the shares—to tender them. This transfer is a longstanding tactic by buyers with unsolicited bids going through stiff-armed resistance by the corporate they hope to purchase.

Funding could also be secured. Shareholder assist? Not a lot.