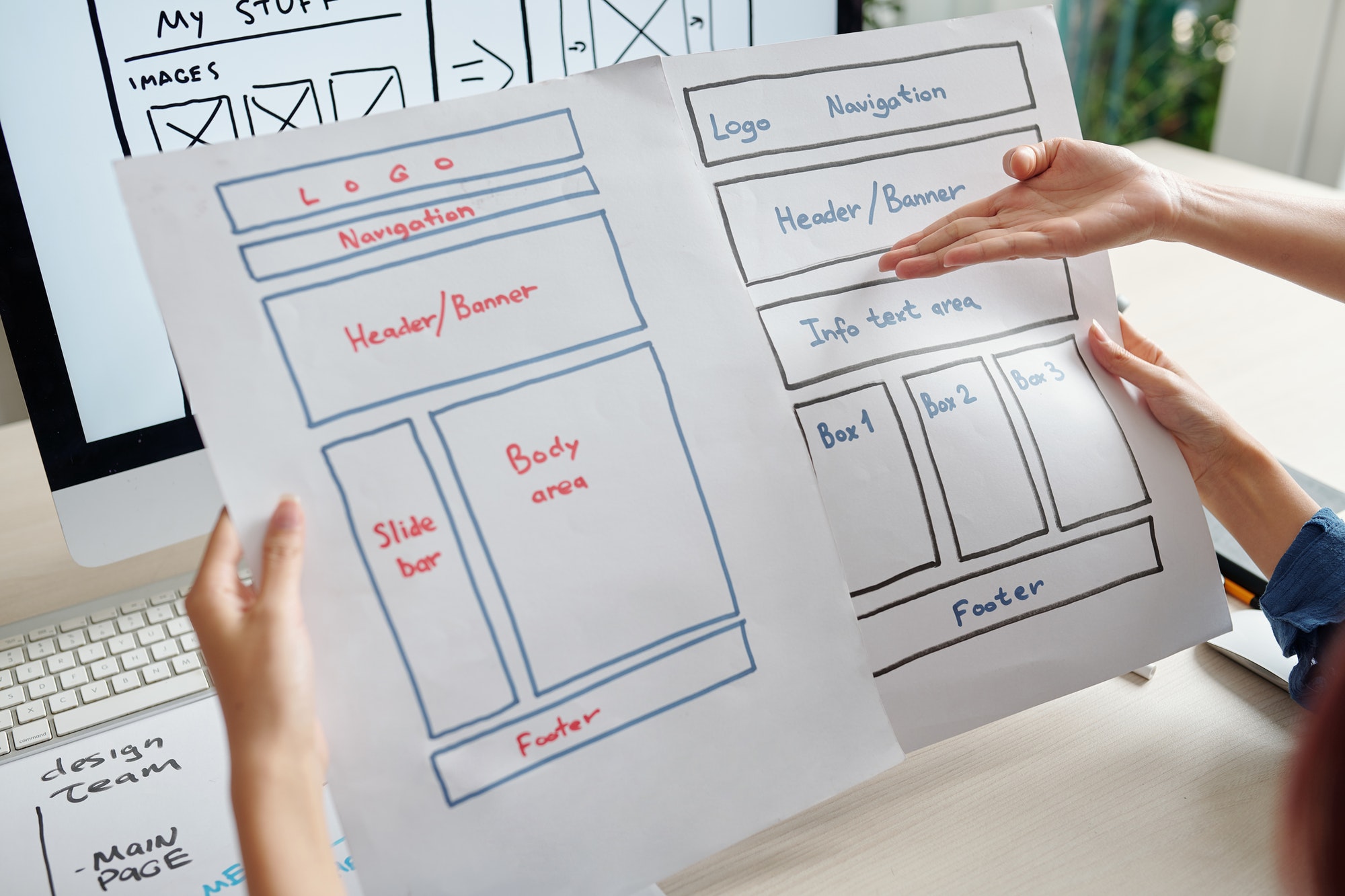

Define. Design. Produce. Transform.

We Create Powerful Brands.

We are home to well-known internet brands and services that are utilised by millions of people every day.

Our Popular Brands

Welcome

We Deliver Value Through Our Brands

Our brands create opportunities and value in every element in the business to talk louder, scale faster, and grow stronger.

Feature

We enrich the digital well-being of the world

Philosophy

We improve and enrich society by delivering high-quality services that assist our users and partners grow.

Mission

Contribute to society by generating value through entrepreneurship and innovation.

Vision

We bring together global knowledge, creativity, and enthusiasm to reach lofty objectives.

Special Offer

Shivaksh Innovation

Advertising & Marketing

Provides market research services as well as online media and marketing solutions.

Business

We share the latest updates, news, opinions and stories on global businesses

News distribution

News distribution refers to the process of disseminating news and information to a wide audience through various channels.

Blockchain

We use a combination of data, news, analysis, sector data to deliver the latest happenings around the blockchain industry.

Entertainment

We cover entertainment, pop culture, and lifestyle on our multiplatform brand.

Media & PR Distribution

News distribution and earned media software and services with a global presence.

Fun Fact

Our Company by Number

We help people and companies all across the world by providing innovative internet services.

Why Choose Us

We bring change to the world with our digital brands

We are home to more than 150 digital brands are available on the site, which is used by individuals all over the world.

Serve

Our spirit is to serve to make our company stronger.

Innovation

We use creativity and persistence to solve problems.

Integrity

We strive to do what is right.

Customer Focus

To keep the customer satisfied.

Portfolio

Our Project

Nex News Network

News Distribution

The Broadcast Media

PR Distribution

Media News Corporation

News PR Distribution Platform

Divaz Media & Films Pvt Ltd.

Media and Entertainment

Lepakshi Media

Digital Media

Media Intelligence

Media Monitoring

Vasudev Media Corporation

Software Development & Media

Free Water

Advertising & Promotion

Aquaterias

Water Information

Our Partners

The essential partnership for long-term sustainable growth

We’ve formed strategic alliances with leading solution and technology providers to provide you with cutting-edge solutions.

Testimonial

What They Say

Shivaksh Media Group transformed our brand image! Kudos to the PR team for their outstanding efforts. Our public perception has never been better.