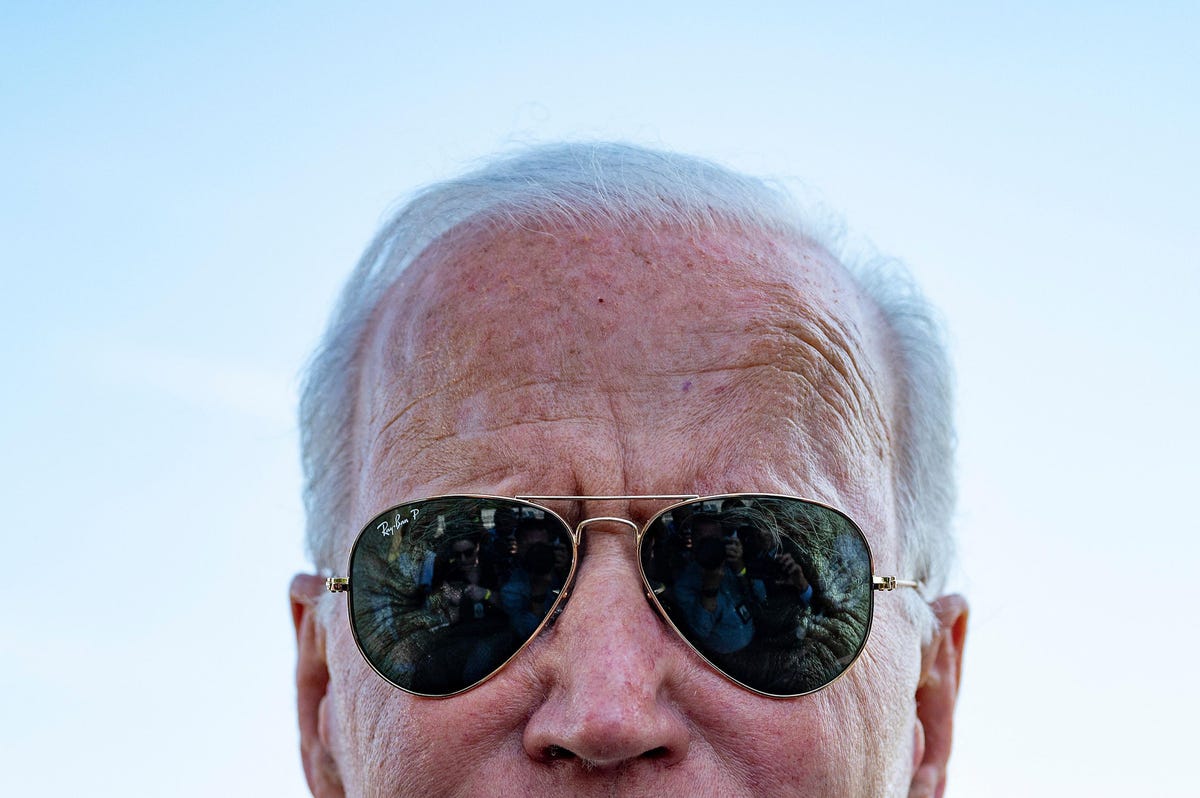

Photograph by Martin-Schoeller // Illustration by Forbes

Phewww. That was quick!

Somewhat over 11 days after Elon Musk proposed paying $54 a share for Twitter, the corporate’s board approved the transaction on Monday, a shock reversal. Twitter initially appeared against the thought—it adopted a poison capsule, a protection in opposition to an unsolicited bid like Musk’s—however warmed as much as it final weekend after Musk detailed how he might pay for it. Reply: Quite a lot of debt (about $25 billion), some fairness (roughly $21 billion), all of it wrapped in Musk’s Tesla shares. (He has plenty of these, round $230 billion price of them.) It provides as much as a $44 billion price ticket on Twitter, a 38% premium over the place the inventory traded when Musk first disclosed his shareholding.

In order that’s it—Elon gained? Can we anticipate to see a spaceship in worker parking beginning any day? In truth, we’re a number of orbits across the solar from that, however Musk is certainly on target to getting what he says he desires.

What Are Musk’s Subsequent Steps?

The settlement between Twitter’s board and Musk doesn’t appear to incorporate a “go store interval.” Some buyout offers have these provisions, a time through which the board welcomes any competing bids. (It’s like when the auctioneer with the honeyed voice begins with, “Going as soon as, going…”) Go-shops fluctuate in size, their phrases dictated by what purchaser and vendor comply with. (Usually, a couple of month to 6 weeks.) Including a go-shop is seen as favorable for buyers, the board doing its finest to get them the best worth. However go-shops aren’t required by regulation in Delaware, the place Twitter is integrated, so it’s not completely unusual for Twitter to not do one. (Skipping it’ll add to the sensation on Wall Avenue that even with JP Morgan’s and Goldman Sachs’ assist, Twitter discovered little curiosity when it shopped itself round over the previous few weeks, making an attempt to keep away from Musk.)

Musk will subsequent make a $54.20 tender supply to boost his shareholding in Twitter to at the least 50% or greater. A young supply is the place he asks shareholders to promote him their shares. He owns 9.2%, some 73.5 million shares. To recover from 50%, he wants one other 319.5 million shares, which is able to value $17.2 billion. Straightforward-peasy. He has $46 billion in financing lined up.

Because the board deliberated final weekend, Musk reportedly spent the weekend on the cellphone with massive shareholders, wooing them. From there, it doesn’t require any rocket science: Musk or some member(s) of Workforce Musk have undoubtedly added up the yeses from final weekend and is aware of Musk can cross over to majority management. There’s the pretty unlikely state of affairs of some sudden shareholder revolt, stopping him from passing 50%. Once more, fairly unlikely. The board has given its stamp of approval, and the deal has acquired a thumbs-up from lots of the analysts following Twitter.

The tender supply will keep open for 20 enterprise days. “After which any shareholder who didn’t tender into his supply will get cleaned up by the corporate,” says Brian Quinn, a company regulation professor at Boston School. “The corporate cuts you a examine for $54.20 for each share you continue to personal.”

What May Cease Musk?

Apart from some unexpected act of god, little or no. U.S. regulators don’t appear prone to oppose it over anti-trust considerations, since Twitter shouldn’t be combining with, say, Snap or one thing.

What we are able to’t account for or actually predict is a few act of Elon. In something Musk associated, there’s a small however non-zero probability of the once-in-a-lifetime sudden factor occurring proper now, instantly at this level in our lifetimes. The person really redefines conference and predictability. One minute, he’s on Twitter making penis jokes involving Bill Gates. The subsequent, he’s shopping for Twitter, having gained approval from a board of 11 extremely educated and effectively compensated administrators, together with Twitter’s cofounder and (twice) former CEO, Jack Dorsey.

What are Musk’s Plans for Twitter—and Twitter Inc.?

The board expects the deal to shut this yr. For now, CEO Parag Agrawal is staying to see that course of end. After that…it gained’t be a shock to see him go, maybe lower than a yr after taking up the job from Dorsey final November. Musk has been none to quiet about his criticism for Agrawal and current-state Twitter. If he desires to fireplace Agrawal, it’ll set off a $38.7 million severance bundle, although it most likely gained’t come to that. Extra broadly, the corporate reportedly told employees there gained’t be any layoffs “at the moment” throughout an all-hands assembly on Monday.

Arising, we get see to if the spaceship government can push Twitter into one thing extra resembling warp velocity. (And if he even actually desires to.) The corporate had grown extra formidable previously couple years after an earlier tangle with one other initially unwelcome investor. However Wall Avenue had come to have rising doubts about whether or not Twitter might hit lofty objectives Dorsey helped set earlier than he left. That features income rising by 50% from 2021 to $7.5 billion in 2023, a daring projection that gained’t be helped by (1) a normal slouch within the advert market proper now over consumer-spending fears, (2) continued fallout from a change to Apple software program that has made cell adverts much less useful and (3) the inherent distraction brought on by a hostile takeover, even one concluding as shortly as this one. (This actually did transfer swiftly. For comparability, the Oracle-PeopleSoft saga stretched over 18 months—18!—to get to the identical level Musk and Twitter reached in lower than three weeks.)

Musk has variously mentioned he’d just like the platform to higher embrace free speech rules, cut back adverts, open up its algorithm, add an enhancing software, improve consumer verification and tamp down on spam bots. He additionally at one level used a TED Speak interview to counsel he didn’t actually care in regards to the enterprise a part of Twitter in any respect. There’s, after all, the complete different a part of Twitter, the cultural cache it emanates—the half that for 16 years has made Twitter a draw for presidents and celebrities alike and a unhealable sore point for one celebrity-turned-president. This tradition half has at all times appeared in nice disproportion to the enterprise half, and such a scenario is a blinking-neon invitation to somebody like Musk, who will assume he can lastly repair what Ev Williams, Dick Costolo and Jack Dorsey (twice) couldn’t, since, hey, it will possibly’t be tougher than rocketing males into outer area on a semi-regular foundation.

Right here’s Musk sounding very Musk-like in a press launch saying the deal, speaking in regards to the future and why he did the factor within the first place:

“Free speech is the bedrock of a functioning democracy, and Twitter is the digital city sq. the place issues important to the way forward for humanity are debated,” mentioned Mr. Musk. “Twitter has great potential – I stay up for working with the corporate and the group of customers to unlock it.”

One factor’s for sure. These alterations will take Musk rather more time (and persistence) than it did to purchase the positioning within the first place.