Topline

Elon Musk has instructed traders he’s wooing to fund his $44 billion deal to take Twitter non-public that they can money out in as few as three years by means of a public inventory providing, the Wall Road Journal reported Tuesday, citing unnamed sources.

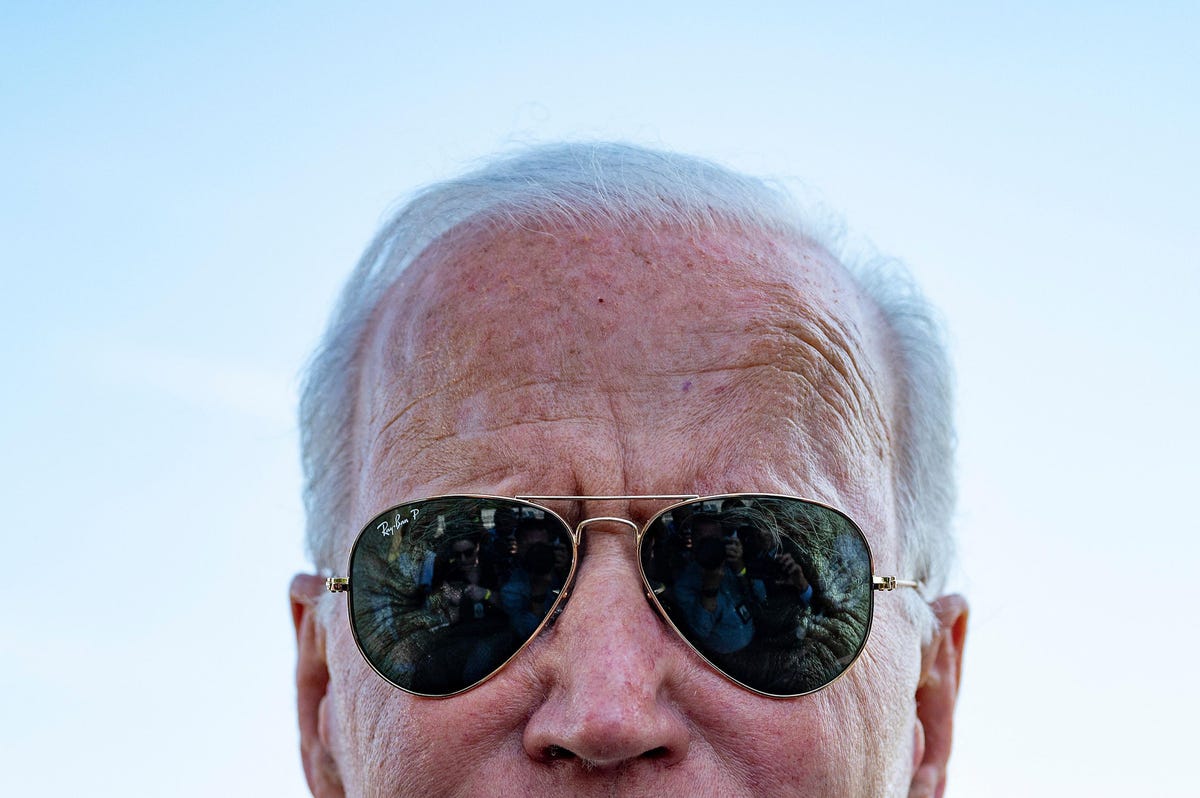

Elon Musk attends The 2022 Met Gala at The Metropolitan Museum of Artwork on Could 2, 2022.

Key Info

Twitter’s board has agreed to a proposal from Musk of $54.20 a share to take the corporate non-public.

Whereas private-equity corporations typically spend about 5 years restructuring an organization earlier than taking it public as soon as extra, Musk’s tentative three-year timeframe may sign he believes he can quickly reform Twitter to enhance its profitability, the Wall Road Journal said.

Since going public in 2013, Twitter has solely turned an annual revenue in 2018 and 2019, and its development has failed to fulfill expectations over the past two quarters.

Contra

Musk’s prior observe report signifies {that a} three-year timeframe for taking Twitter public once more could possibly be overly optimistic. At Tesla, Musk has repeatedly introduced deadlines that the corporate has failed to fulfill. Concerning missed manufacturing deadlines for the Tesla Mannequin 3, Musk remarked that he’s “dumb at predicting dates.”

Key Background

On April 4, Musk announced that he had acquired a 9.2% stake in Twitter, and later that month provided to purchase the complete firm for $44 billion. The corporate’s board initially balked on the proposal, however accepted after Musk disclosed he had secured $46.5 billion in financing. This features a $12.5 billion margin mortgage in opposition to Musk’s stake in Tesla and $13 billion in loans in opposition to Twitter. Monday, Reuters and the WSJ have reported that Musk is looking for further companions to be able to cut back how a lot of the remaining $21 billion would come from the Tesla margin mortgage or out of Musk’s personal pocket, with the WSJ reporting that Apollo International Administration eying becoming a member of the deal. The deal between Musk and Twitter features a $1 billion cancellation payment for both social gathering.

Tangent

Whereas going public could give an organization the chance to boost capital, it additionally creates an obligation to launch monetary statements to shareholders and the general public, with quarterly reporting pressures decreasing the leeway executives have with their firm.. In 2018, Musk announced that he was contemplating taking Tesla non-public, remarking that, as a publicly traded firm, Tesla was topic to “wild swings” in stock-price and short-term earnings incentives that distracted from longer-term objectives. Lower than three weeks later, Musk said that Tesla would stay public, following suggestions from shareholders.

Additional Studying

“Musk Reportedly Seeks More Financing For Twitter Acquisition” (Forbes)